You have two great options to pitch your startup and meet investors at the Startup Conference:

The Official Pitch Competition

Launch your startup in style by pitching a panel of VCs on the main stage, in front of a large audience.

Only 6 startups will be selected to be a Finalist and pitch on the main conference stage in the morning. The audience will vote for the top 3, who will then come back and give a second pitch on stage. A panel of VCs will deliberate publicly and select the winner of the year.

Some of our winners have been successfully acquired or went on to raise significant funding.

Choose this option if your startup is ready to fly!

The Pitch Track

Pitch your startup to professional investors and get direct feedback on your idea and your pitch. If your pitch is awesome, you may investors will want to schedule follow-up meetings. But even if they don’t, the feedback they provide will be invaluable.

Choose this option if you are not quite ready to launch but want to test the waters with investors before going all-in fundraising.

The link to apply for the Pitch Track is in your registration confirmation e-mail.

I pitched to one of the VCs during the VC office hours and his feedback was an invaluable tool for me. Will most definitely attend it again” — 2018 attendee.

Open Mike

For super-early stage entrepreneurs, we also offer an open mike during the conference for people looking for co-founders. You get just a minute in front of the audience to ask for whatever you want (most people are looking for co-founders or first business partners).

Can I apply to both the Pitch Competition and the Pitch Track?

Yes. Just be aware that the pitch competition is a lot more selective than the pitch track, but it’s fine to apply to both and do both.

How important is the 1-minute video pitch when applying?

Very important. If you can’t be bothered to film a 1-minute video of your pitch, you are probably not ready to pitch professional investors.

The video itself can be rough, shot from Starbucks with background noise, that doesn’t matter. What matters is what you say.

Do I need to be registered to pitch?

Yes. Both the Pitch Competition and the Pitch Track are reserved to attendees of the Startup Conference.

The links on how to register is contained in the confirmation e-mail you receive when you register for the conference.

How much time do I get to pitch investors?

For the Pitch Track: you get about 7 minutes to pitch and get feedback, plus you get to listen in other entrepreneurs’ pitch, which also a great learning experience. You will be placed in a 1-hour session with other entrepreneurs. The format gives enough time for the investors to provide you directly with feedback on your startup, as well as more general advice at the end of the session for all the entrepreneurs present.

You should keep your pitch short enough (2 to 3 minutes max) so the investors get time to engage in a meaningful discussion with you. A common mistake that entrepreneurs make is to try to address every possible objection in their initial pitch. Wrong! The pitch runs too long and loses its punch. Instead, your goal should be to get the investor curious enough that they want to find out more. Let them ask the questions and be ready with great answers.

Some of the investors who attended the 2019 conference

Jeff Clavier

Jeff Clavier is Managing Partner at Uncork Capital, a seed-stage venture firm in Palo Alto and San Francisco. He founded Uncork Capital in 2004 (then called SoftTech VC) to provide active support and capital for companies in their first 18 months of life. Jeff has helped numerous companies reach successful outcomes, including Eventbrite (NYSE:EB); Sendgrid (NYSE:SEND); Fitbit (NYSE:FIT); and Mint.com (Intuit). His current investments include Vidyard, Postmates, Vungle, Molekule, Shippo and Front. Jeff was born in France, and graduated from Université Paris Descartes with an MS in Computer Science. He was formerly the CTO and an early employee at Effix, a fintech startup that sold to Reuters. In 2000 he immigrated to the U.S. and joined RVC, Reuters’ $450 million corporate venture capital fund, as a general partner. He is a board member of the National Venture Capital Association.

Arjun Arora

Arjun Arora is Partner at 500Startups the most active early stage venture firm in the world. Arjun is currently “In Residence” at Expa and advises funds, startups and Fortune 100 companies. He is also a Part-Time Partner with the House Fund (investing in UC Berkeley student and alum founded companies). Arjun was the Founder of ReTargeter which was acquired by Sellpoints (March 2015). Arjun was the founding CEO of ReTargeter and bootstrapped the company to be in the top 100 of Inc’s Fastest Growing Companies list in 2013. Arjun graduated from UC Berkeley with degrees in Electrical Engineering, Computer Science and Entrepreneurship & Technology.

Ravi Mulugu

Ravi Mulugu is a Partner with UL Ventures, the corporate venture arm of Underwriters Laboratories. He focuses on early stage venture investments related to Cybersecurity, Autonomous Systems and Digital Manufacturing. Before joining UL Ventures, Ravi was a Principal at Next47 (Siemens Venture Capital) where he invested in growth stage startups in Smart Grid, Industrial IoT and Analytics. Ravi received a Masters degree in Electrical Engineering from the University of Texas at Arlington and an MBA from the UCLA Anderson School of Management.

Bill Reichert

Bill Reichert is Managing Director of Garage Technology Ventures, a leading seed-stage and early-stage venture capital fund, based in Silicon Valley. Garage makes seed investments in promising early stage technology companies and works intensively with them to help them to the next step. Some of Garage’s most successful startups include Pandora, Tripwire, LeftHand Networks, Coremetrics, Hoku Scientific, Kaboodle, WhiteHat Security and Simply Hired.

Bill has spent most of his career as an entrepreneur and operating executive. Prior to joining Garage in 1998, Bill was a co-founder and senior executive at several early-stage, venture-backed technology companies, including Trademark Software, The Learning Company, Infa Technologies, and Academic Systems. Earlier in his career, Bill worked at McKinsey & Co. in Los Angeles, the World Bank in Washington, DC, and Brown Brothers Harriman & Co. in New York. Bill earned his BA from Harvard University and his MBA from Stanford University.

Email: reichert@garage.com

Desk: 650.383.5659

Twitter: @billreichert

Website: http://www.garage.com

Pavel Cherkashin

Pavel Cherkashin, Managing Partner at Mindrock Capital and GVA Capital, VC funds based out of San Francisco, CA with more than $200M under management and the portfolio of fast-growing tech startups including Diamond Foundry, Establishment Labs (NASDAQ:ESTA), Luminar Technologies, OmniScience, Opus12, People.ai, Telegram, Vipkid, and many others. Pavel moved to Silicon Valley in 2013 from Moscow, Russia, where he started and sold 3 successful companies (Actis/Wunderman, AdWatch/Aegis, Sputnik Labs/TechnoServ). He also served as corporate executive at Adobe and Microsoft.

Harper Cheng

Harper Cheng is an angel investor at Sand Hill Angels. She works as a senior hardware system integrator in Pixel engineering team at Google. She worked as a senior power system design engineer in Mac engineering team at Apple for over 5 years. Prior to Apple, she worked as a power management engineer at Renesas Electronics America and Marvell Semiconductor. She is looking into entrepreneurial opportunities. She is also involved in real estate investment and rental property management. She is very passionate in philanthropy supporting healthcare services and medical research.

Michael Sidgmore

Michael Sidgmore is a Partner at Broadhaven Ventures, where he has led investments into Credijusto, ScaleFactor, Trizic, Nowports, Kovi, Beam Solutions, Liveoak Technologies, Starship HSA, and house of gigs. He has spent his career as a financial technology investor and entrepreneur focused on the financial infrastructure, wealth management, and specialty finance sectors. Prior to Broadhaven Ventures, he was a pre-product employee and SVP at iCapital Network, where he helped build the family office and RIA networks of the online investment platform that has over $40 billion in assets and has received over $50 million in funding from investors including BlackRock, Blackstone, and Carlyle. Prior to iCapital Network, Michael was the first sales hire and Director of Institutional Investments at Mosaic, a financing platform for solar loans that has originated over $1 billion and has received $295 million in funding from Warburg Pincus and other investors. He was formerly an investment professional with Goldman Sachs’ Principal Strategic Investments group in London, a direct investing team focused on market structure and financial technology. Michael is a Board Member of Liveoak Technologies and Starship HSA and a Board Observer and Advisor at Scalefactor, Trizic, and Credijusto. He is also the Founder and Managing Member of M4Fund and Sixth Man Capital. Michael holds a BSc in International Relations from the London School of Economics.

Steffen Bartschat

Steffen Bartschat is a member of Sand Hill Angels, one of the most active angel groups in the world. During his day job as CEO of Hill88, Steffen helps large corporates engage with the Silicon Valley ecosystem. He has held senior management positions ranging from early stage startups (Lumo BodyTech) to Fortune 50 corporations (IBM) in the consumer, automotive, and enterprise software sectors.

Steffen holds B.S. and M.S. degrees in Electrical Engineering from Carnegie-Mellon University and an M.S. in Business Management from Stanford Graduate School of Business.

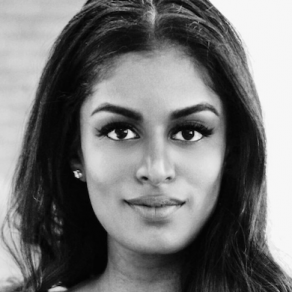

Harshitha Kilari

Harshitha directs investment research and helps shape the overall strategy of the firm. She’s particularly intrigued by the multidisciplinary nature of the blockchain space and enjoys exploring its intersection between economics, finance, and technological innovation.

Prior to Decipher, she did a stint as the CFO of an edtech startup and spent three years in the prestigious TAP program at Capital Group.

She holds a B.A. in Economics-Mathematics from Columbia University, which she completed in 3 years.

Seth Rosenberg

Prior to joining Greylock, Seth worked as a Product Manager at Facebook where he led initiatives for the Messenger Developer Platform. He oversaw the transition from Facebook to a standalone Messaging app, managed integrations with key partners, such as Uber, Lyft and KLM, and launched the open developer platform, with over 30,000 developers. In just two years, Messenger went from 200 million users to 1 billion users.

Before Facebook, Seth worked at Goldman Sachs in New York doing tech & media investment banking. At Goldman, Seth helped take companies public, including RetailMeNot and Intelsat, worked on financings for AT&T, and helped with the sale of Tekelec to Oracle. Seth received a Bachelor of Commerce with Honors from Queen’s University.

Seth is originally from Winnipeg, Canada and is a West Coast transplant.

Nuno Goncalves Pedro

Nuno is Grishin Robotics’ Venture Partner. Grishin Robotics is a series A and B Sand Hill Rd firm focused on Smart Hardware with investments in companies such as Zume Pizza, Starship, Zipline, Spin, Yellow, Ring, eero and others. He is also the Managing Partner & Founder of Strive Capital, the San Francisco Bay area’s first quant micro-VC firm, now focused on “deep” AI and Blockchain, with investments in companies like AppAnnie, KeepSafe, Gusto and Rubrik. He has had a 22 year career in Tech as a Product Manager, Operator, Investor and Board member in the Bay area, Europe and Asia, and was previously a Senior Expert and member of the Asia-Pacific leadership team at McKinsey & Co, based in Beijing.

Armando Biondi

Armando Biondi is co-founder & COO of AdEspresso, acquired by Hootsuite in Feb 2017. Investor in 75 startups and AngelList Lead. Guest Contributor for Entrepreneur, FastCompany, BusinessInsider, VentureBeat. Also: 500Startups Mentor, Independent Board Member, former Radio Speaker.